FM in Narayani avatar, gets Indians out of PANic room

2 min read

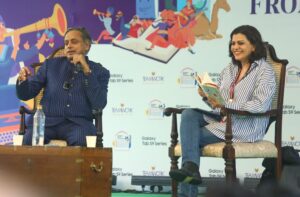

Finance Minister Nirmala Sitharaman with fellow parliamentarians Om Birla (speaker) and Anurag Thakur

When FM Nirmala Sitharaman concluded her maiden budget speech as finance minister on the floor of the Parliament, New Delhi-resident Atnu Mitra Roy was a visibly happy man. His takeaway from the budget was not the cess slapped on oil prices, or the hike in other luxury items and cigarettes. The numbers rolling out on the television screen on Gaon, Garib aur Kisaan had long faded from his memory since the TV was put to rest after FM’s Naari tu Narayani speech eulogizing women and their different avatars was over.

What caught his fancy was that he no longer required a PAN (Permanent Account Number) to file his tax returns. All he would need now is his Aadhaar number, which the FM spelled out – twice for the convenience of those tuning in – was now interchangeable with PAN. He had his reasons. After all, Roy was very recently denied a job opportunity because the company pointed out to the discrepancy in the names mentioned on his PAN and Aadhaar. His PAN number was listed against Atnu Mitra Roy, while his Aadhaar spelled out his name as AM Roy. The Aadhaar complaint section is flooded with such complaints of discrepancies in names and a little scrolling would reveal how our brethren from South India, who carry the names of their father as their first name with pride, are the most harassed lot.

The FM’s decision was part of a broad-based reform ushered in the digital trade and taxation measures. Those of you who use digital modes of payment have good news coming up. Just scroll below to find out more:

- Interchangeability of PAN and Aadhaar. “Even if you don’t have a PAN, Aadhaar would do,” Sitharaman said.

- TDS of 2 per cent applicable on withdrawal of cash exceeding Rs 1 crore.

- Business establishments with annual turnover of Rs50 crore and above will have to mandatorily offer modes of digital transactions such as BHIM, RuPay, plastic money, among others. They cannot levy any charges on the merchant and customers for digital modes of payment.

- New integrated transport payment system is being designed around RuPay. Under this, one common card with RuPay application will power hassle free travel across India.

- Another small but consequential reform is the relaxation in filing of GST (Goods and Services Tax) for businesses with an annual turnover less than Rs5 crore. Such establishments can now file quarterly returns instead of monthly filings.

- Also, under wings: A dedicated channel on DD for the start-ups, of the start-ups to be run by the start ups

- Ground-breaking initiative allowing listing of social welfare and voluntary organisations on SEBI so “they can raise capital like equity and debt as in MF (Mutual Funds)”.